are union dues tax deductible in 2020

There are however a few exceptions and if your union dues meet one of the exceptions listed below you are in luck. However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017.

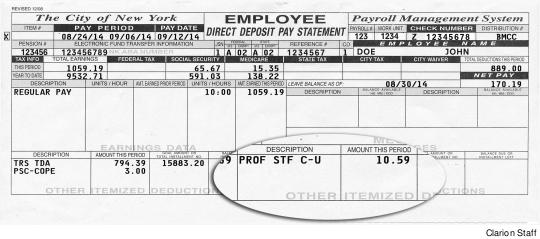

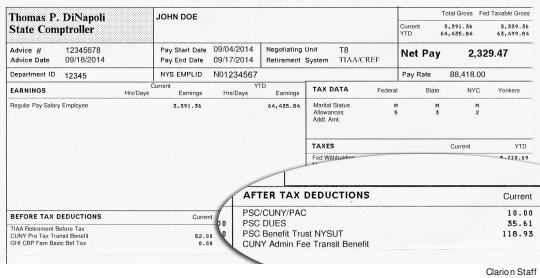

Are You A Union Member Psc Cuny

If you are self-employed you can enter your union dues as a Schedule C business expense.

. A 2020 Center for American Progress Action Fund brief stated This type of above-the-line deduction would allow union members to deduct the costs of earning their income and result in the tax code more accurately measuring individuals ability to pay Opposition to union dues deductions. Offer valid for returns filed 512020 - 5312020. Due to tax reform union dues became due deductions instead of deductions.

Click Itemized or Standard Deductions to expand the category then click Unreimbursed employee expenses - Subject to 2 of AGI limit. What union dues are deductible. And they lost a tax break in last years tax reform bill.

Deduction of union dues. No employees cant take a union dues deduction on their return. I just did a return with Housing Allowance listed there.

To enter union dues in TaxAct. Educator expense tax deduction renewed for 2020 tax returns. This is in response to an email we received from Craig Mutter on November 23 2020 and our discussion of January 14 2021 DAngeloMutter asking whether legislative changes made in Albertas Bill 32.

A 2020 Center for American Progress Action Fund brief stated This type of above-the-line deduction would allow union members to deduct the costs of earning their income and result in the tax code more accurately measuring individuals ability to pay Opposition to union dues deductions. And yes the clergy do have unions in Great Britain and Canada. That is the deductibility has been suspended for tax years 2018 through 2025 inclusive.

You are an employee other than statutory employee and. June 3 2019 1127 AM. Politicians and the public tend to view them unfavorably.

Labor Day 2018 doesnt bring much good news for unions. HR Block does not provide audit attest or public accounting services and therefore is not registered with the board of. Taxpayer is clergy Now Im wondering just hypothetically whether union dues on a clergy return could be used as a deduction for self-employment tax.

From within your TaxAct return Online or Desktop click on the Federal tab. Annual dues for membership in a trade union or an association of public servants. A reminder for tax season.

Under current federal law employee business expenses are generally not deductible. Professional board dues required under provincial or territorial law. Membership in the workplace organizations has at best stalled.

If you are an employee you can claim your union dues as a job-related expense if you itemize deductions. Deduction for excess premium. That would be fun to explain to a programmer.

We have printed a chart you can use to compute the amount deducted on your behalf and remitted to the UFT. Eligible educators can deduct up to 250 of qualified expenses you paid in 2020. To enter your union dues for work performed as.

However the job-related expenses deduction is still available to people who work in one of these specific professions or situations. Line 21200 was line 212 before tax year 2019. Are Union Dues Tax Deductible 2020.

You can claim a tax deduction for these amounts on line 21200 on your tax return. If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied. The deduction would last through 2025.

Union dues may be tax deductible subject to certain limitations. In tax years 2018 through 2025 union dues employee expenses and all taxable activity as a corporation will no longer qualify for deduction if either employee or corporation itemizes their deductions. Restoring Balance in Albertas Workplaces Act 2020 Bill 32.

Prior to that year a union member could write off yearly dues as an unreimbursed employee business expense. The payments are a condition of continued membership in a union and membership is related directly to your present job. During the year ending Dec.

Brigitte Richer 2020-087195. In other words union dues would get the same treatment now reserved for things like insurance premiums and retirement contributions. On certain bonds such as bonds that pay a variable rate of interest or that provide for an interest-free period the amount of bond premium allocable to a period may exceed the amount of stated interest allocable to the period.

The short answer is that dues may not be subtracted from taxable income in the tax years 2018 through 2025. On smaller devices click the menu icon in the upper left-hand corner then select Federal. 31 2021 the City of New York and other employers deducted union dues for the UFT from those UFT members who were so designated.

An individual who is self. Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your employement. But theres a faint light for unionized workers thanks to a bill to restore their dues deduction and make the expense easier.

The Joint Committee on. The payments are a required wage deduction under an agency shop agreement. If youre the primary beneficiary of the union dues and your employer pays them on your behalf you cannot claim a tax.

Tax reform eliminated the deduction for union dues for tax years 2018-2025. This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall into one of the qualified categories of employment claiming a deduction relating to unreimbursed employee expenses. If this occurs treat the excess as an itemized deduction on your Schedule A Form 1040.

This prohibition was written into the tax reform legislation passed by the US. Job-related expenses arent fully deductible as they are subject to the 2 rule. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union dues too.

The amount of union dues that you can claim is shown in box 44 of your T4 slips or on your receipts and includes any GSTHST you paid. Union dues assessments and initiation fees are allowable business expenses if one or both of the following is true. Miscellaneous itemized deductions are those.

Union Dues Deductible On State Taxes Not On Federal Taxes Hawaii State Teachers Association

Ibew New Bill Would Restore Tax Deduction For Union Dues Cinemontage

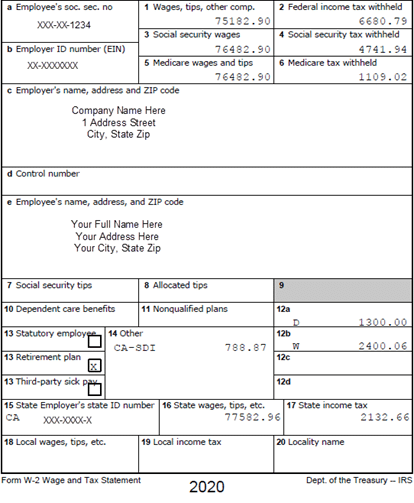

Understanding Your W 2 Controller S Office

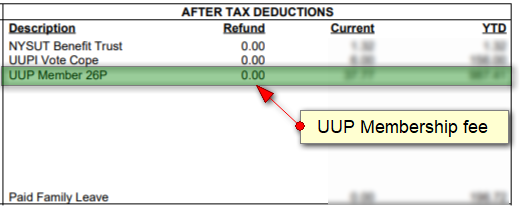

Deducting Union Dues On Nys Taxes Uup Buffalo Center

Are You A Union Member Psc Cuny

How To File Your Taxes And Tax Tips For Part Time Workers

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Different Types Of Payroll Deductions Gusto

Understanding Your W2 Innovative Business Solutions

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

Deducting Union Dues Drake17 And Prior

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

A Tax Break For Union Dues Wsj

Membership Dues Tax Deduction Info Teachers Association Of Long Beach

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Solved Where Do I Enter New York State Teacher Union Dues For Nys Taxes

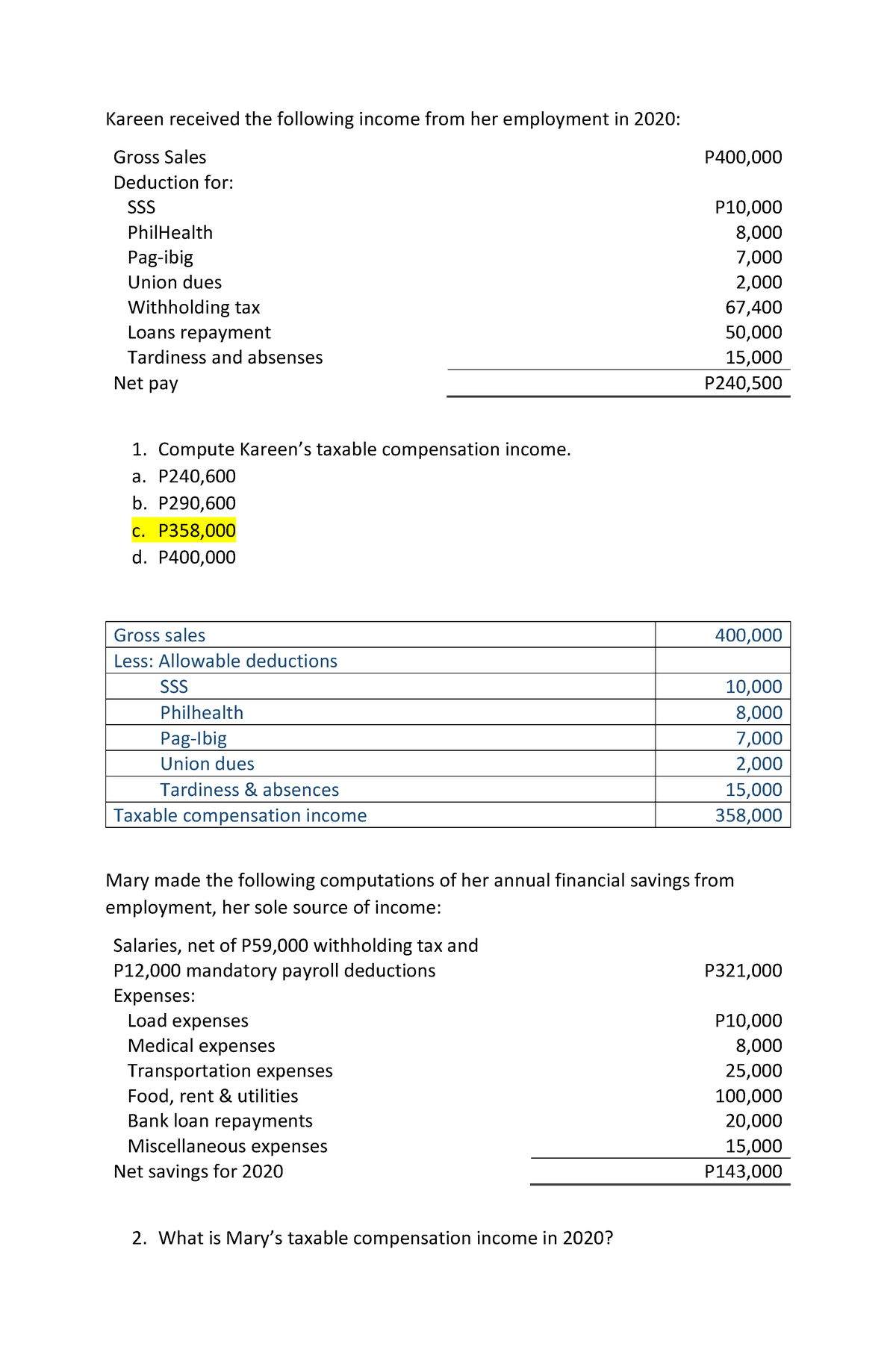

Tsr Individual Taxpayer Problem Pre With Answers Kareen Received The Following Income From Her Studocu